Tennessee DSCR Loans

EasyRent is our tailored and industry-leading DSCR Loan solution for Tennessee real estate investors. Whether you are acquiring property to expand your portfolio or cashing out your capital in a refinance, we have a loan for you. Our DSCR Lending Program has solutions for anyone – from first-time investors to industry veterans looking to rapidly scale their portfolios. We are confident we can find you a great Tennessee DSCR loan in a quick, efficient and easy process. Click the button below and get started today!

Need a DSCR Loan in Tennessee?

Got any questions?

What is a DSCR Loan?

A DSCR Loan is a mortgage loan for a residential income-producing property. It is primarily based on the “Debt Service Coverage Ratio” or the cash flow of the property, rather than the borrower’s income. A traditional mortgage loan will require income verification, tax returns and a “Debt-to-Income” (DTI) ratio. DSCR Loans require none of these! Perfect for real estate investors ready to scale (no more W2!) or are looking leave behind the hassle, paperwork and headaches of conventional financing, DSCR Loans are quickly becoming the go-to loan option for real estate investors.

For a comprehensive definition, “DSCR Loans are mortgage loans secured by residential real estate turnkey properties strictly used for a business purpose and underwritten primarily based on the property.”

DSCR Loan Definition Breakdown

- Mortgage Loans = form of loan that is secured by collateral, collateral = real estate

- Residential Real Estate = properties used for people to live in vs. commercial, which is used to operate businesses (offices, retail, industrial, hotel, self-storage, etc.). In real estate finance, residential also typically refers to “1-4 unit” properties, anything more would be considered “multifamily”

- Business Purpose = DSCR loans strictly do not allow the owner of the property to live in the property, it must be used for “business” or investment purposes. Includes use of “cash-out proceeds”

- Underwritten = How lender evaluates (and then prices) the risk of the loan

- Primarily Based on Property = Mostly based on property, but also look at sponsor

- Turnkey = property doesn’t require any renovation, “turn the key and go”

Looking to get a deeper understanding of all things DSCR? Check out our DSCR Loans Guide below!

Tennessee Recent DSCR Fundings

Real Investments. Real Results.

Real estate investors in the Volunteer State are turning to DSCR Loans as a strategic tool to expand and manage their investment property portfolios. DSCR loans allow investors to secure financing based on the property's ability to generate income (rather than an investor's individual credit profile). In a market like Tennessee, where real estate prices have shown steady growth and rental demand remains steady, DSCR loans offer investors a flexible and effective means to acquire new properties, improve existing ones, or refinance their assets. Easy Street Capital is proud to be a leading provider of DSCR loans for Tennessee real estate investors looking to build rental portfolios! Check out our most recently funded DSCR loans in Tennessee below:

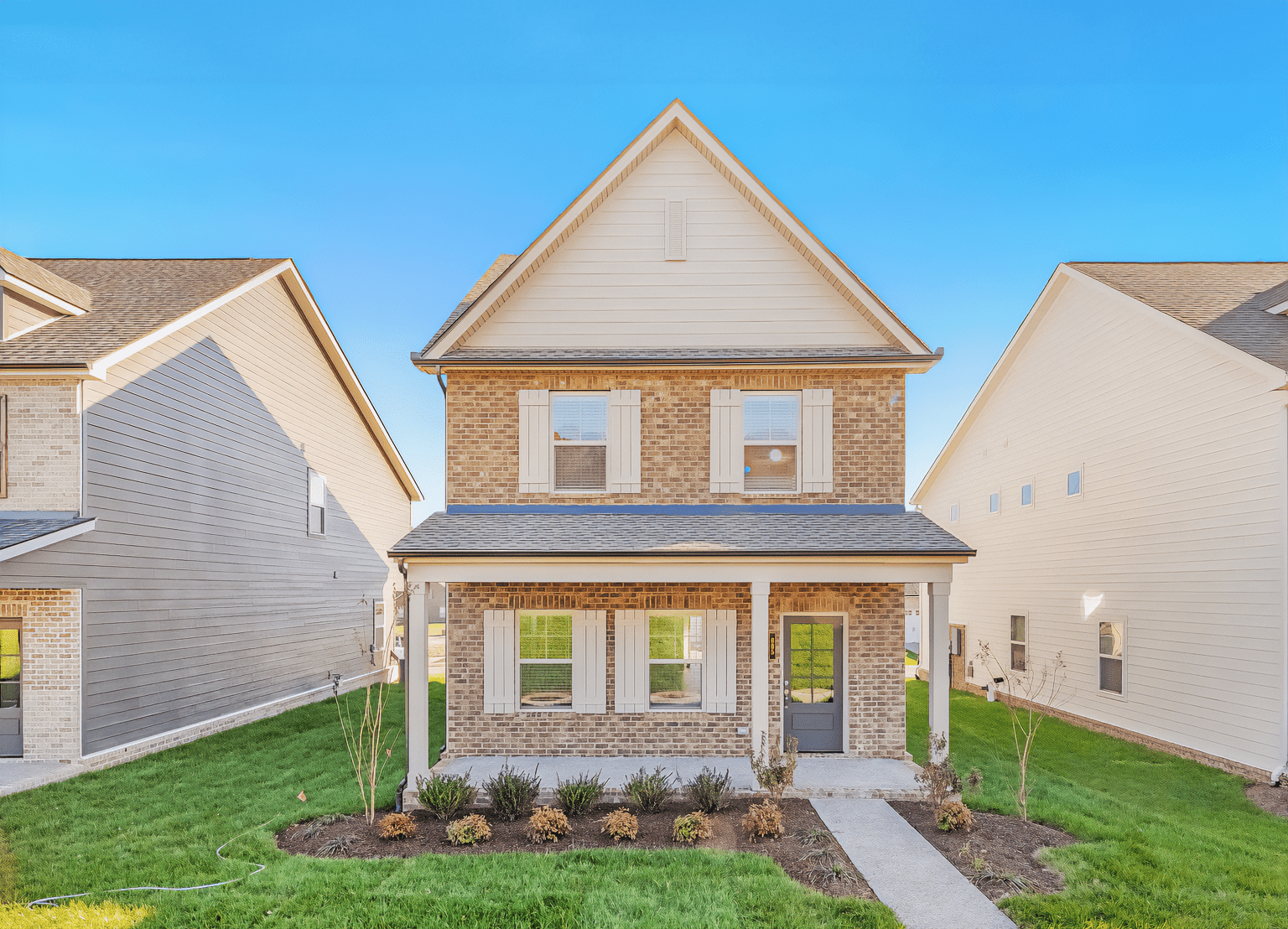

PUD

Gallatin, TN

$218,000 Tennessee DSCR Rental Loan for an Acquisition of a rental property in Gallatin. This newly-built, traditional-style home is located in the desirable Carellton subdivision with amenities like a playground and pool. It offers easy access to downtown Nashville and surrounding areas.

PUD

Pigeon Forge, TN

$600,000 Tennessee DSCR Rental Loan for a Cash-Out Refinance of a rental property in Pigeon Forge. This cabin-style, short-term rental property features an indoor, inground pool, a covered porch, fireplace, and stainless steel appliances. The residence is within four miles of all of the town’s major attractions including theme parks, museums, dinner theatres, and other family-oriented recreational activities.

Multifamily (10-Unit)

Columbia, TN

$1,183,000 Tennessee DSCR Rental Loan for a Rate-Term Refinance of a rental property in Columbia. This fully occupied property is within walking distance of local restaurants, employment centers, parks, and other large and local retailers.

Single-Family Residence

Sevierville, TN

$1,470,000 Tennessee DSCR Rental Loan for a Cash-Out Refinance of a rental property in Sevierville. This short-term rental features an indoor pool and an elevated deck offering magnificent views of the Smokey Mountains.

Single-Family Residence

Sevierville, TN

$446,250 Tennessee DSCR Rental Loan for an Acquisition of a rental property in Sevierville. This STR faces the mountain view, offering a lovely sight for visitors. Being part of the Smoky Mountains, the property offers the perfect getaway location for anyone looking to take advantage of the scenery, along with the nearby trails, camp sites, museums, theme parks, among others.

Single-Family Residence

Gatlinburg, TN

$730,000 Tennessee DSCR Rental Loan for a Cash-Out Refinance of a rental property in Gatlinburg. Nestled in scenic landscapes of the Great Smoky Mountains, one of America’s most visited national parks, Gatlinburg is a captivating tourist haven as it seamlessly blends natural beauty with a plethora of entertainment options.

Single-Family Residence

Memphis, TN

$88,900 Tennessee DSCR Rental Loan for a Cash-Out Refinance of a rental property in Memphis. Since original purchase in 2021, renovations include new windows, fresh interior paint, and new hardwood floors throughout.

Single-Family Residence

Dryersburg, TN

$77,800 Tennessee DSCR Rental Loan for a Rate-Term Refinance of a rental property in Dryersburg. An experienced investor recently renovated this property in Northwestern Tennessee. Recent renovations that included new vinyl siding, a new roof, and new windows.

Single-Family Residence

Madison, TN

$382,000 Tennessee DSCR Rental Loan for a Rate-Term Refinance of a rental property in Madison. Madison is a suburban neighborhood in northeast Nashville and has access to employment, schools, restaurants, entertainment, and shopping. Only 15 miles from downtown Nashville, the property location is perfect for having access to the thriving music scene, while having privacy and space in a neighborhood.

Apply Today

Take the next step in your investment journey with a trusted, reliable lender that has your best interest in mind. Get in touch or request a quote today.