New York DSCR Loans

EasyRent is our tailored and industry-leading DSCR Loan solution for New York real estate investors. Whether you are acquiring property to expand your portfolio or cashing out your capital in a refinance, we have a loan for you. Our DSCR Lending Program has solutions for anyone – from first-time investors to industry veterans looking to rapidly scale their portfolios. We are confident we can find you a great New York DSCR loan in a quick, efficient and easy process. Click the button below and get started today!

Need a DSCR Loan in New York?

Got any questions?

What is a DSCR Loan?

A DSCR Loan is a mortgage loan for a residential income-producing property. It is primarily based on the “Debt Service Coverage Ratio” or the cash flow of the property, rather than the borrower’s income. A traditional mortgage loan will require income verification, tax returns and a “Debt-to-Income” (DTI) ratio. DSCR Loans require none of these! Perfect for real estate investors ready to scale (no more W2!) or are looking leave behind the hassle, paperwork and headaches of conventional financing, DSCR Loans are quickly becoming the go-to loan option for real estate investors.

For a comprehensive definition, “DSCR Loans are mortgage loans secured by residential real estate turnkey properties strictly used for a business purpose and underwritten primarily based on the property.”

DSCR Loan Definition Breakdown

- Mortgage Loans = form of loan that is secured by collateral, collateral = real estate

- Residential Real Estate = properties used for people to live in vs. commercial, which is used to operate businesses (offices, retail, industrial, hotel, self-storage, etc.). In real estate finance, residential also typically refers to “1-4 unit” properties, anything more would be considered “multifamily”

- Business Purpose = DSCR loans strictly do not allow the owner of the property to live in the property, it must be used for “business” or investment purposes. Includes use of “cash-out proceeds”

- Underwritten = How lender evaluates (and then prices) the risk of the loan

- Primarily Based on Property = Mostly based on property, but also look at sponsor

- Turnkey = property doesn’t require any renovation, “turn the key and go”

Looking to get a deeper understanding of all things DSCR? Check out our DSCR Loans Guide below!

New York Recent DSCR Fundings

Real Investments. Real Results.

Real estate investors in the Empire State are turning to DSCR Loans as a strategic tool to expand and manage their investment property portfolios. DSCR loans allow investors to secure financing based on the property's ability to generate income (rather than an investor's individual credit profile). In a market like New York, where real estate prices have shown steady growth and rental demand remains steady, DSCR loans offer investors a flexible and effective means to acquire new properties, improve existing ones, or refinance their assets. Easy Street Capital is proud to be a leading provider of DSCR loans for New York real estate investors looking to build rental portfolios! Check out our most recently funded DSCR loans in the Empire State below:

Single-Family Residence

Hunter, NY

$851,900 New York DSCR Rental Loan for an Acquisition of a rental property in Hunter. This beautifully remodeled property features high-end finishes, a modern kitchen with custom cabinetry, and expansive windows that fill the space with natural light. Located near Hunter Mountain’s year-round outdoor activities and the charming Hunter Village, it offers a perfect blend of luxury and adventure for a short-term rental.

Single-Family Residence

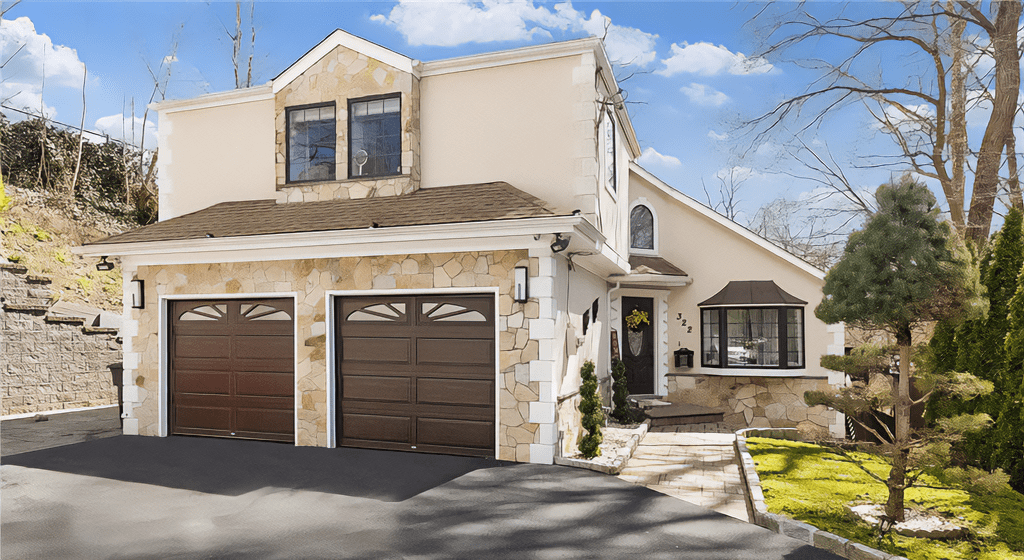

Yonkers, NY

$614,250 New York DSCR Rental Loan for a Rate-Term Refinance of a rental property in Yonkers. Located within a mile of two major highways that facilitate travel south to Manhattan, this suburban residence features an updated kitchen and bathrooms as well as two fireplaces, a wood patio, and a two-car garage.

Duplex

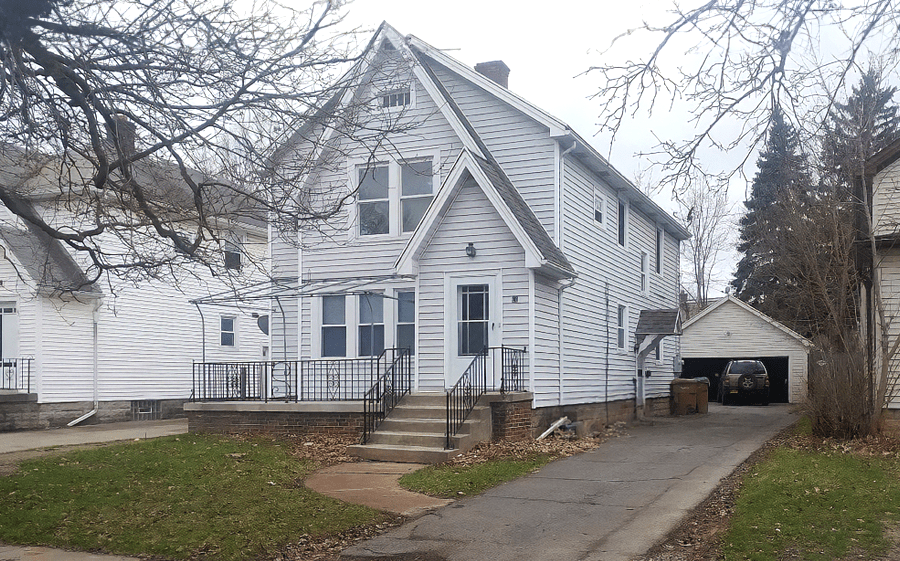

Buffalo, NY

$149,800 New York DSCR Rental Loan for a Rate-Term Refinance of a rental property in Buffalo. This duplex features an open porch, a two-car garage, and a full basement. It is located in a suburban neighborhood northeast of downtown Buffalo, surrounded by similarly styled properties.

Single-Family Residence

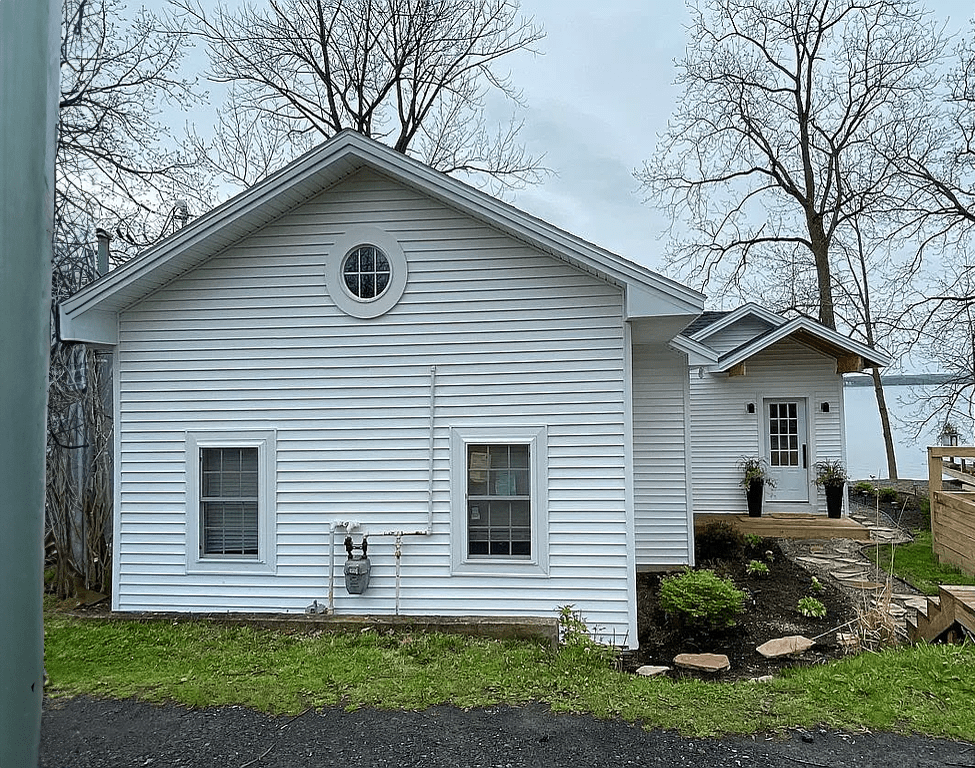

Seneca Falls, NY

$492,800 New York DSCR Rental Loan for an Acquisition of a rental property in Seneca Falls. This property backs up to the picturesque Cayuga Lake, one of the Finger Lakes, which can be admired from the spacious deck. Upon acquisition, this home will be used as a short-term rental.

Multifamily (5-Unit)

Watertown, NY

$175,000 New York DSCR Rental Loan for a Cash-Out Refinance of a rental property in Watertown. With five total units, this multifamily property is located just a few blocks from downtown and currently fully occupied on long-term leases.

Single-Family Residence

Center Moriches, NY

$765,000 New York DSCR Rental Loan for an Acquisition of a rental property in Center Moriches. This property offers enjoyable waterfront views with an open deck at its rear that leads directly to Moriches Bay. The home will be utilized as a short-term rental upon acquisition.

Single-Family-Residence

Albany, NY

$172,250 New York DSCR Rental Loan for a Cash-Out Refinance of a rental property in Albany. Featuring three bedrooms and one bathroom, the property has been thoroughly updated since acquisition with an updated kitchen, new flooring, and an updated bathroom. Only eight miles from downtown Albany, the property has access to major roadways, shopping, employment centers, and any essential services.

Single-Family Residence

Saugerties, NY

$512,250 New York DSCR Rental Loan for a Cash-Out Refinance of a rental property in Saugerties. The neighborhood features characteristics wanted by the majority of homeowners such as easy access to shopping, schools, and employment. Saugerties is located just off the Hudson River in central New York and near many attractions such as hiking and nature areas, Woodstock, and niche resorts.

Single-Family Residence

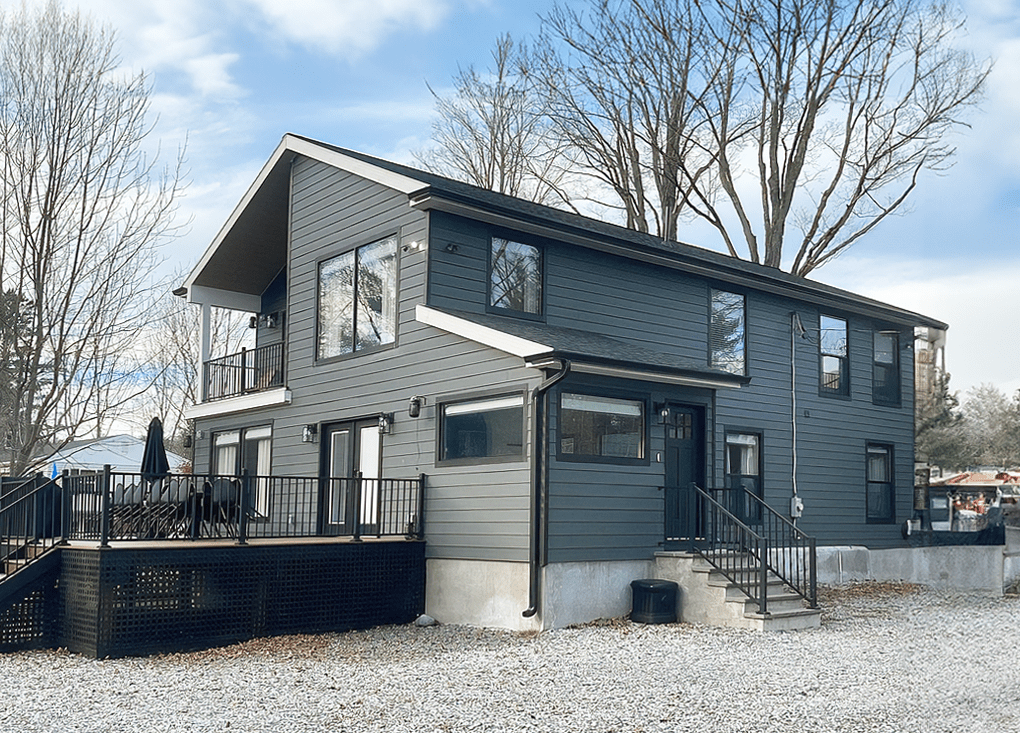

Bernhards Bay, NY

$208,000 New York DSCR Rental Loan for a Cash-Out Refinance for a rental property in Oswego. This short-term rental is directly on the water of Dakin Bay on the pristine Oneida Lake. Tenants in the summer will wake up to sunrise views of the big blue lake with rolling mountains in the distance. They can enjoy boating, fishing, hiking, swimming, and can grab a burger next door at the Sand Bar + Grill.

Apply Today

Take the next step in your investment journey with a trusted, reliable lender that has your best interest in mind. Get in touch or request a quote today.